Tax planning with impact..

The UK has hundreds of tax reliefs, exemptions and allowances which our team of Chartered Tax Advisors aim to maximise for clients. Curiously, all tax reliefs are classified into just 5 categories:

International

The UK has international agreements with over 100 countries. These are known as Double Tax Agreements and they typically take precedence over other tax legislation

Thresholds

Don’t be fooled into thinking that your Personal Allowance of £12,570 is an act of generosity. It exists because HMRC could otherwise be swamped with Tax Returns reporting small sums of income which are not worth pursuing

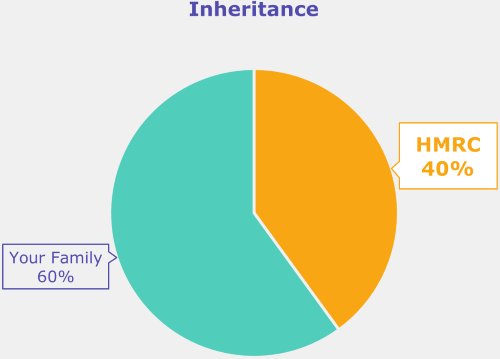

Same goes for the Inheritance Tax (IHT) Annual Exemption, as without it you would have to report insignificant gifts, and keep burdensome records. Same is true of the Capital Gains Tax (CGT) Annual Exemption

Targeted

This type of relief is very specific and generally comes with a fairly short shelf-life. For example, at the moment the Government appears keen to fulfil its international commitments on reducing CO2, so there’s 100% write-off on electric cars, but only if purchased before April 2025

Special Cases

Most of these reliefs apply to charities, religious bodies, educational institutions etc. It’s important to remember they are not ‘set in stone’ as private schools are just finding out that VAT will be chargeable on their fees!

Structural

These reliefs define the scope of a tax and aim to avoid double taxation. For example, if a taxpayer gifts shares to a trust, the gift is a Chargeable Lifetime Transfer, subject to immediate IHT, but at the same time it is a disposal for CGT purposes

Imposing two taxes was always seen as unfair (the Budget appears to have changed that!) so Holdover Relief may be available

Arrange your FREE power-hour discussion here . You’re free to accept, or refuse, and there’s no obligation whatsoever

Toodle pip