I’m on my way, don’t know where I’m going..

It was a problem for Paul Simon, and Julio, back when sentiments around schoolyards were different

The majority of people now talking to us about passing on their lifetime’s work, their legacy, to their children, and grandchildren, were just kids back then

For a fair number, their property, or investment business, started as a hobby and then became an addiction

By some measure, they were always judged on results. They were working in the business, not on the business

As Carl Jung wrote, the individual path is ‘the way you make for yourself, which is never prescribed, which you do not know in advance, and which simply comes into being when you put one foot in front of the other’

Jung’s advice was to ‘do the next and most necessary thing’. That mantra served business owners well, and helped maintain sanity through moments of crisis

Typically, it took parents around 30 years both to create something of value, and a real tax mess for their children

Most people say they would do exactly the same things over again. Well, to paraphrase Andrew Carnegie, ‘gold is only as good as the man doing the digging’ and they’re typically right in their assertion

Trouble is, when the ‘brains’ behind the business dies, so does the intellectual capacity that created it!

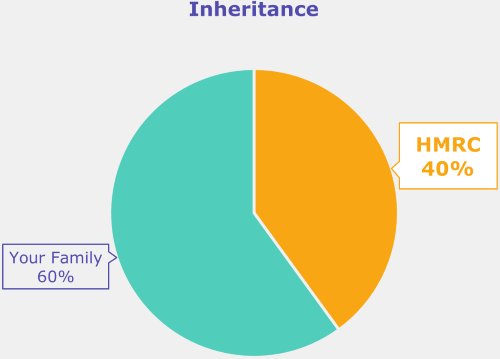

Emotions are high, death duties have to be paid within tight timeframes, and there may have to be a fire-sale of assets to satisfy HMRC

It’s easy to legally fix everything (except bringing ‘brains’ back to life!) so, get out of your own way, and engage our property tax experts to deliver for your children the outcomes you worked so hard your whole life to create

Let our team of Chartered Tax Advisors review your legacy tax planning. Experience the Power of a FREE Hour here

Toodle pip